Every year, mobile loan apps are becoming more and more popular among ordinary users. If before they were perceived with some level of distrust, at the moment banks have already lost many of their customers who regularly borrow money. If you are also a frequent user of these kinds of services, which is not surprising…

Blog

Human growth hormone

Human growth hormone is produced by the anterior pituitary gland. Its greatest amount is secreted in childhood and then gradually decreases. Growth hormone affects the human liver and causes its cells to produce insulin-like growth factors (IGF). Normally, after the end of puberty in the human body, the formation of new muscle cells almost completely stops. …

How to learn to shoot with AK-47 in CS:GO

In this article, we will share some basic tips that will help you learn how to properly shoot with the AK-47. If you want to make your AK-47 unique, you can take a closer look at all csgo cases.

Basic tips on online roulette

Since Roulette is largely a game of chance, someone might think that there are no tips you can give towards gameplay. But this is simply not true. There are still tips about your gameplay and especially your mindset while playing that can all lead to better play at the wheel. If you want to find…

How to develop effectively in social networks?

No matter how hard skeptics try to convince us in the opposite direction, but we still confidently assert that the promotion in the online sphere in any case can not be considered a futile venture. Perhaps most of the original opponents of this statement have already managed to change their opinion. We believe that making…

Forex Dealers and Brokers

Trading on the currency market attracts not only high profitability, but also more than affordable investments in trading, because all kinds of intermediary organizations provide their clients with several options of trading accounts, which, among other things, differ in deposit minimums. So, any trader can begin trading by depositing from 15 dollars (and in some…

What Is Crowdfunding? Definition, How It Works, Types

Statistically, 1 in 10 projects is fully moneyed on the site.Lending, Club is a debt-based crowdfunding website due to the fact that it is a P2P financing system. It uses up to $40,000 in personal financings and approximately $500,000 in tiny company funding. Each finance term is 3 or 5 years. To certify, your firm…

The optimal system of trading in energy resources

The modern sector of energy trading is quite promising and can really bring you interesting results. You just need to pay more attention to this kind of electronic auctions, which will help your company to solve certain problems. Eventually, this will allow you to join the bidding and optimize certain important categories for your business,…

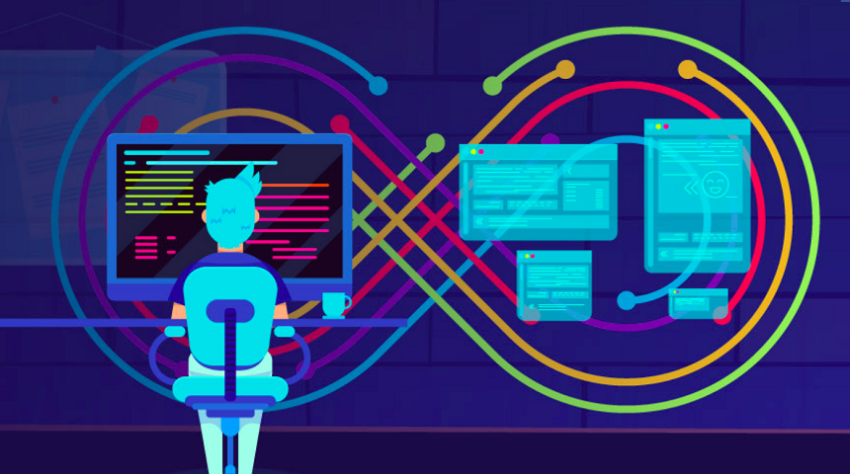

How does an IT specialist introduce DevOps culture in his company?

The DevOps direction is actively developing, and many IT specialists are interested in it, copy knowledge and think about implementing DevOps tools in their company. But before going to the manager with a proposal, a specialist should have a plan with a ready-made solution, a list of responsible persons, specific tasks, implementation stages and arguments…

Purchase of natural gas with Prozorro

Constant use of the Prozorro portal can open before you completely new rather interesting tools. The fact is that with this portal you can get some significant benefits, which will primarily relate to more efficient work in this segment and a transparent system of participation in such bidding. The portal itself was designed to enable…